The global food system currently contributes a quarter of all greenhouse gas emissions, and it’s predicted that this issue will worsen. The United Nations (U.N.) estimates that by 2050, there will be an additional 2 billion people to feed, requiring a 70% increase in food production to meet demand.

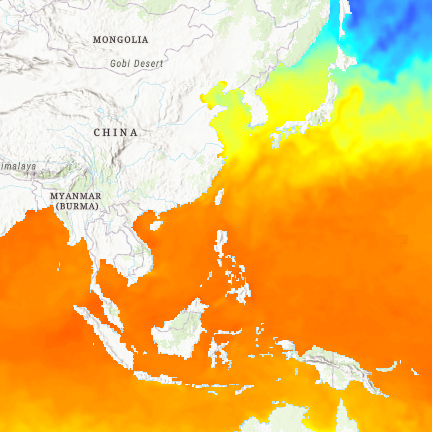

Fortunately, there is a way to reduce the environmental impact of feeding the world. Wild seafood, when integrated into a balanced diet, can help alleviate the demand for red meat while providing a healthy source of protein and essential nutrients. Marine fisheries already play a crucial role in food security, providing nutrition to over 700 million people globally. Furthermore, restoring the ocean’s health could potentially feed 1 billion people with a seafood meal daily.

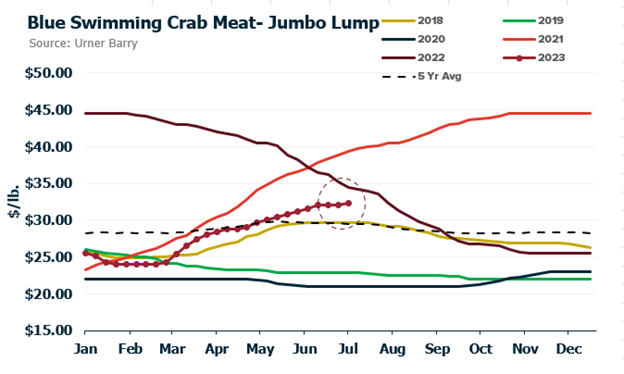

Research by Dr. Jessica Gephart and a team of 17 other international researchers has reaffirmed that wild fisheries have significantly lower CO2 emissions compared to beef, mutton, cheese, pork, and poultry. Moreover, they require minimal fresh water and land resources for harvesting. This comprehensive assessment examined 23 species groups, which account for over 70% of the world’s “blue food” production, encompassing both aquaculture and capture products.

When compared to a well-known study on the environmental impact of other protein sources conducted in 2018 by Joseph Poore and Dr. Thomas Nemecek, the benefits of wild seafood become apparent. Carbon emissions from wild seafood are six times lower than beef, five times lower than mutton, and over two times lower than cheese.

The wide variety of aquatic foods offers numerous nutrient-rich options, surpassing the limited range of land-based animal proteins available to most consumers. More than 2,370 wild seafood species are currently being harvested, with over 620 species being raised through aquaculture, according to the U.N.’s Food and Agriculture Organization.

These aquatic foods are rich in essential vitamins, fatty acids, and minerals like calcium, iron, and zinc. For vulnerable populations, access to nutrient-packed fish could significantly improve their diets. Globally, 690 million people suffer from hunger, and more than 2 billion people experience “hidden hunger” due to micronutrient deficiencies.

Thankfully, we don’t have to choose between nourishing people and preserving our natural resources. By adopting a country-by-country approach, we can protect biodiversity in our oceans, mitigate climate change, and ensure that the most vulnerable populations have access to the food they need.

The original article pre-edited is available at Oceana.org

Signature Catch Crimson Snapper

Signature Catch Crimson Snapper